2025 Annual General Meeting

Tuesday 11 November 2025

NAOS Small Cap Opportunities Company Limited advises that its Annual General Meeting (AGM) will be held at 9.45 am (AEDT) on Tuesday, 11 November 2025, at Castlereagh Room 1, Sheraton Grand Sydney Hyde Park, 161 Elizabeth Street, Sydney NSW 2000.

Further details relating to the AGM will be advised in the Notice of Meeting to be sent to all shareholders and released to the ASX immediately after dispatch.

In accordance with the ASX Listing Rules, valid nominations for the position of Director are required to be lodged at the registered office of the Company no later than 5.00 pm (AEST) on 16 September 2025.

FY25 Final Quarterly Dividend Dates

Ex-Dividend Date

Wednesday 10 September 2025

Record Date

Thursday 11 September 2025

Last Date for DRP Election

Friday 12 September 2025

Payment Date

Tuesday 30 September 2025

NAOS Investor Roadshow

The NAOS Investor Roadshow will be coming to a city near you this October. Join us as the investment team discusses its investment philosophy and process, and provides an outlook on the market. We will also highlight a selection of stocks that are held within our Listed Investment Companies (LICs).

We invite you to come along with a guest, meet us in person, and understand more about NAOS Asset Management (NAOS) and our LICs. Register today to secure your seat.

Adelaide

Thursday, October 9, 2025

10:30am - 12pm ACDT

The Playford Adelaide - MGallery

120 North Terrace

Adelaide, SA 5000

Perth

Thursday, October 16, 2025

10:30am - 12pm AWST

InterContinental Perth

City Centre, an IHG Hotel

815 Hay Street

Perth, WA 6000

Brisbane

Tuesday, October 21, 2025

10:30am - 12pm AEST

Sofitel Brisbane Central

249 Turbot Street,

Brisbane, QLD 4000

Melbourne

Tuesday, October 28, 2025

10:30am - 12pm AEDT

Hilton Melbourne

Little Queen Street

18 Little Queen Street

Melbourne, VIC 3000

Sydney

Thursday, October 30, 2025

10:30am - 12pm AEDT

Australian Museum

1 William Street

Darlinghurst, NSW 2010

Pre-Tax Net Tangible Assets per Share

Post-Tax Net Tangible Assets per Share

FY25 Dividend (cents per share)

Dividend Yield

Share Price

Shares on Issue

Directors’ Shareholding (number of shares)

Profits Reserve (cents per share)

NSC Investment Portfolio Performance* | S&P/ASX Small Ordinaries Accumulation Index | Performance Relative to Benchmark | |

|---|---|---|---|

1 Year | -9.08% | +12.26% | -21.34% |

3 Years (p.a.) | -10.41% | +10.00% | -20.41% |

5 Years (p.a.) | -0.58% | +7.38% | -7.96% |

Inception (p.a.) | -2.36% | +5.33% | -7.69% |

Inception (Total Return) | -16.57% | +48.23% | -64.80% |

David Rickards OAM has been an Independent Director of the Company since 28 February 2018 and was elected Chair of the Company on 10 November 2022. David is also the Independent Director of NAOS Ex-50 Opportunities Company Limited (ASX: NAC). He is also Co-Founder of Social Enterprise Finance Australia Limited (Sefa) and was a director and treasurer of Bush Heritage Australia for nine years.

David has over 25 years of equity market experience, most recently as an executive director at Macquarie Group, where he was head of equities research globally, as well as equity strategy from 1989 until he retired in mid-2013. David was also a consultant for the financial analysis firm Barra International.

David holds a Master of Business Administration majoring in accounting and finance from the University of Queensland. He also has a Bachelor of Engineering (Civil Engineering) and a Bachelor of Engineering (Structural Engineering) from the University of Sydney, and a Bachelor of Science (Pure Mathematics and Geology).

Sebastian Evans has been a Director of the Company since 20 October 2017. Sebastian is also a Director of NAOS Ex-50 Opportunities Company Limited (ASX: NAC), NAOS Emerging Opportunities Company Limited (ASX: NCC) and has held the positions of Chief Investment Officer (CIO) and Managing Director of NAOS Asset Management Limited, the Investment Manager, since 2010.

Sebastian is the CIO across all investment strategies. He holds a Master of Applied Finance (MAppFin) majoring in investment management, as well as a Bachelor of Commerce majoring in finance and international business, a Graduate Diploma in Management from the Australian Graduate School of Management (AGSM) and a Diploma in Financial Services.

Sarah Williams was appointed as an Independent Director of the Company on 25 August 2022. Sarah is also an Independent Director and Chair of NAOS Ex-50 Opportunities Company Limited (ASX: NAC) and NAOS Emerging Opportunities Company Limited (ASX: NCC).

Sarah has over 25 years’ experience in executive management, leadership, IT and risk management in the financial services and IT industries. Most recently, Sarah was an executive director at Macquarie Group and head of IT for the group’s asset management, investment banking and leasing businesses. During her 18-year tenure at Macquarie Group, she also led the Risk and Regulatory Change team and the Equities IT team and developed the IT M&A capability. Sarah has also held senior roles with JP Morgan and PricewaterhouseCoopers in London.

Sarah has been a director of charitable organisations, including Cure Cancer Australia Foundation and Make A Mark Australia. Sarah holds an honours degree in engineering physics from Loughborough University.

Trevor Carroll has been a Director of the Company since 27 March 2017. Trevor was formerly Australia and New Zealand CEO of Electrolux Home Products. With over 30 years’ experience in consumer-focused product strategy, brand marketing, and manufacturing, Trevor’s experience extends to membership of the Electrolux Global Product Council, which is responsible for product development worldwide. Following retirement as CEO, Trevor undertook a role in Shanghai, advising Electrolux China on product strategy. In recent years, Trevor has been a director of The Good Guys, Fusion Retail Brands, Big Sister Food Group, and Crane Group.

He is an emeritus member of the Australian Industry Group Board, where he was National President between 2006 and 2008.

Trevor holds a Bachelor of Commerce from Canterbury University (NZ).

Warwick Evans has been a Director of the Company since 20 October 2017. Warwick is also a Director of NAOS Ex-50 Opportunities Company Limited

(ASX: NAC), NAOS Emerging Opportunities Company Limited (ASX: NCC) and Chair of NAOS Asset Management Limited, the Investment Manager.

Warwick has over 35 years of equity market experience, most notably as Managing Director of Macquarie Equities (globally) from 1991 to 2001, and as an executive director for Macquarie Group. He was founding Chairman and CEO of the Newcastle Stock Exchange (NSX) and was also Chairman of the Australian Stockbrokers Association. Prior to these positions, Warwick was an executive director at County NatWest.

Warwick holds a Bachelor of Commerce majoring in economics from the University of New South Wales.

Dear fellow shareholders,

On behalf of the Board, welcome to the Annual Report of NAOS Small Cap Opportunities Company Limited (Company) for the financial year ended 30 June 2025. We extend our appreciation to all shareholders for your continued support and warmly welcome new shareholders who joined us in FY25.

The past 12 months have been defined by a shifting economic environment, with the RBA cutting interest rates in late 2024 and early 2025 to bolster economic activity, offset by volatile commodity prices, lagging inflationary pressures and a volatile macro backdrop. What did remain constant was the continued demand for large and liquid listed businesses, which saw the continued outperformance of the largest listed businesses in Australia.

Against this backdrop, NSC delivered a -9.08% investment return for FY25, underperforming the S&P/ASX Small Ordinaries Accumulation Index return of +12.26%. While disappointing, this result was materially impacted by a one-off portfolio event in February 2025. Core holding, BSA Limited (ASX: BSA), lost a critical tender renewal from its largest customer, NBN Co., causing its share price to drop by ~90% by year-end. Encouragingly, from March to June 2025, the portfolio rebounded strongly with a cumulative return of ~+24%, reaffirming our confidence in the strength and quality of NSC’s core investments.

For the financial year, the Company recorded an after-tax loss of $9.08 million (compared to an after-tax loss of $24.28 million in FY24). The Board has declared a final quarterly dividend of 1.25 cents per share (unfranked), bringing the full-year FY25 dividend to 5.0 cents per share (50% franked overall). This represents a yield of 17.86% based on the 30 June 2025 closing share price of $0.28.

Since inception, the Company has declared 38.5 cents per share in dividends, or 53.57 cents on a grossed-up basis, with the majority fully franked. The profits reserve of the Company stands at 7.5 cents per share as at 30 June 2025.

NSC Dividend History

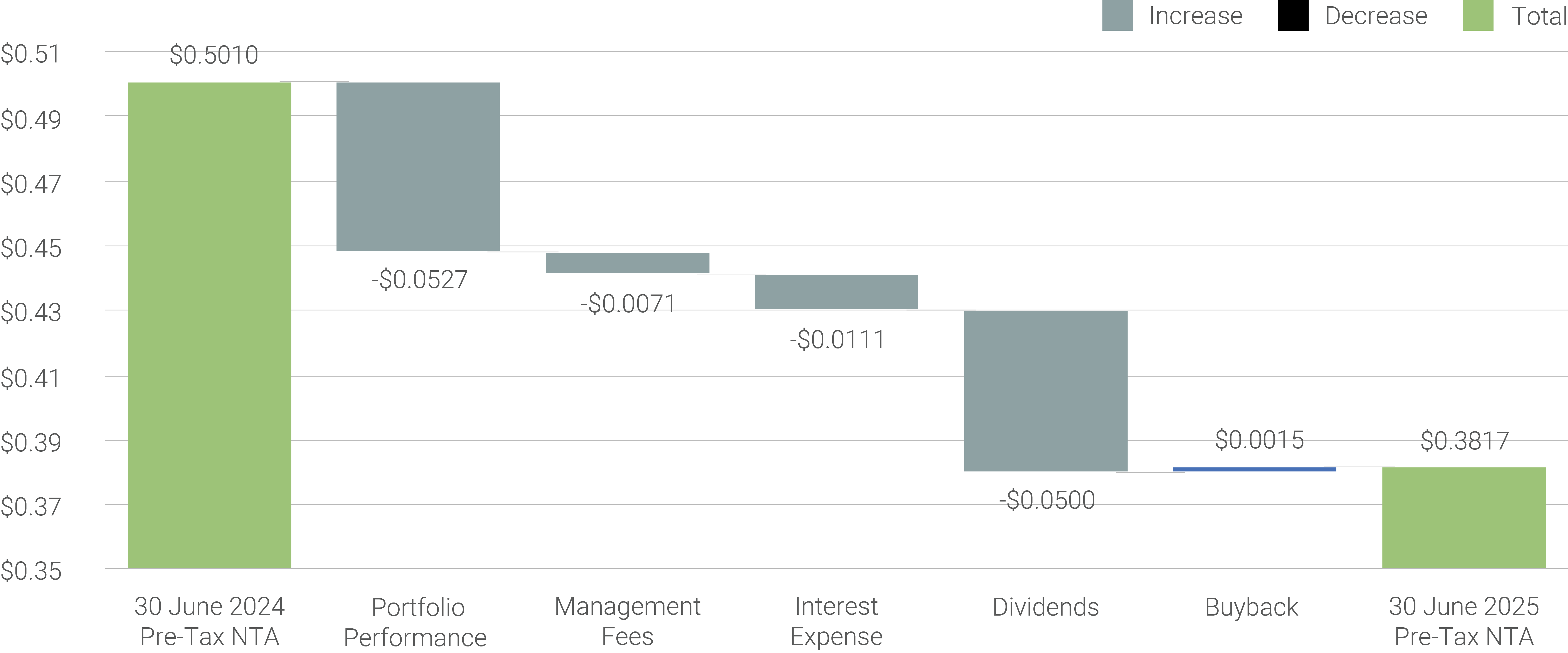

Through FY25, the pre-tax Net Tangible Asset backing (NTA) per share of the Company decreased from $0.50 to $0.38 over the financial year, as shown in the following chart.

NSC Pre-Tax NTA Performance

Throughout the year, the Board maintained a disciplined and opportunistic capital management strategy focused on enhancing long-term shareholder value. Key initiatives included:

Despite the challenging year for NSC, as we enter FY26, the Board strongly believes that the NSC investee companies will continue to re-rate to fair value as they have started to do so since March of this calendar year. Importantly, alignment between shareholders, the Board, and the Investment Manager continues to deepen, with Directors and the NAOS staff now holding 3.2 million NSC shares.

On behalf of the Board, thank you once again for your ongoing trust and support.

Kind Regards,

David Rickards OAM

Independent Chair

21 August 2025

Dear fellow shareholders,

For the financial year ending 30 June 2025 (FY25), the NSC Investment Portfolio decreased by -9.08% compared to the Benchmark S&P/ASX Small Ordinaries Accumulation Index (XSOAI), which increased by +12.26%. As most readers may know, FY25 was turned on its head in February when core holding BSA Limited (ASX: BSA) lost a critical tender renewal from its largest customer, NBN Co., causing its share price to drop by ~90% by year-end. As the BSA investment, its risks, and subsequent events were covered in detail in the FY25 Q3 Quarterly Investment Report, I won’t revisit them here. For those interested in a deeper understanding, I encourage you to refer to that report for further context.

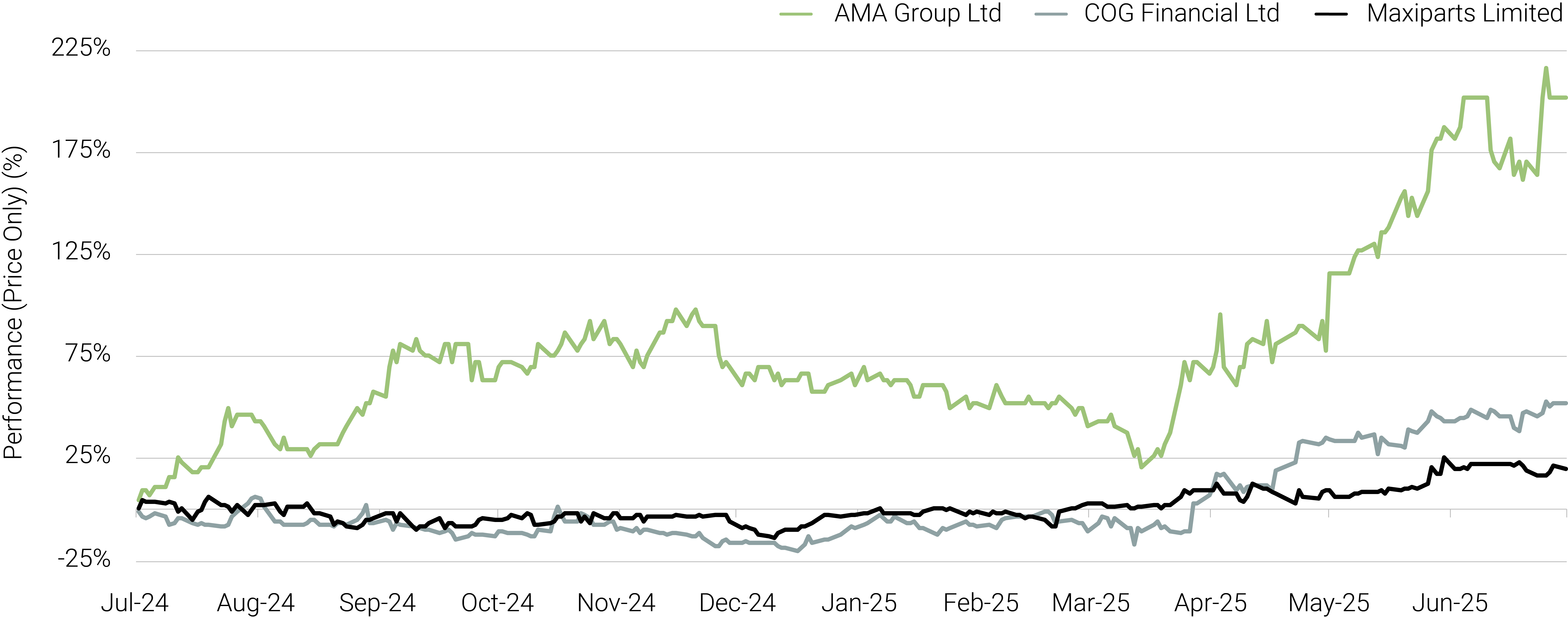

Post February, the Investment Portfolio delivered a ~+24% return, driven by substantial share price gains in core holdings such as COG Financial Services (ASX: COG), MaxiPARTS (ASX: MXI), and AMA Group (ASX: AMA), which had experienced flat or negative returns in prior years (as shown in the below chart). Despite these recent gains, we believe these investments retain significant medium-term upside potential as their cash generation strengthens and growth opportunities emerge, with further details provided later in this letter.

Share Price Performance - AMA, COG & MXI

For several years, I have noted that high interest rates, significant inflows into passive investing, and the rise of alternative strategies, such as private credit, have driven many investors away from emerging companies as a serious investment class. This has resulted in reduced liquidity, lower valuations, and fewer investable businesses due to market consolidation, with numerous listed emerging companies acquired by strategic investors.

Over the past six months, however, we have seen early signs of investors returning to the emerging companies segment. It appears to us that declining interest rates and supply-demand challenges in alternative strategies, such as private credit, are shifting the risk-return dynamics. As the economic outlook improves, it has placed many emerging companies in stronger positions to produce more consistent earnings growth over the medium term. We believe these combined forces could spark a valuation renaissance for emerging companies, with those generating stable, growing cash flows likely to command premium valuations over the next 2-3 years.

Relevance, Momentum and Index Inclusion

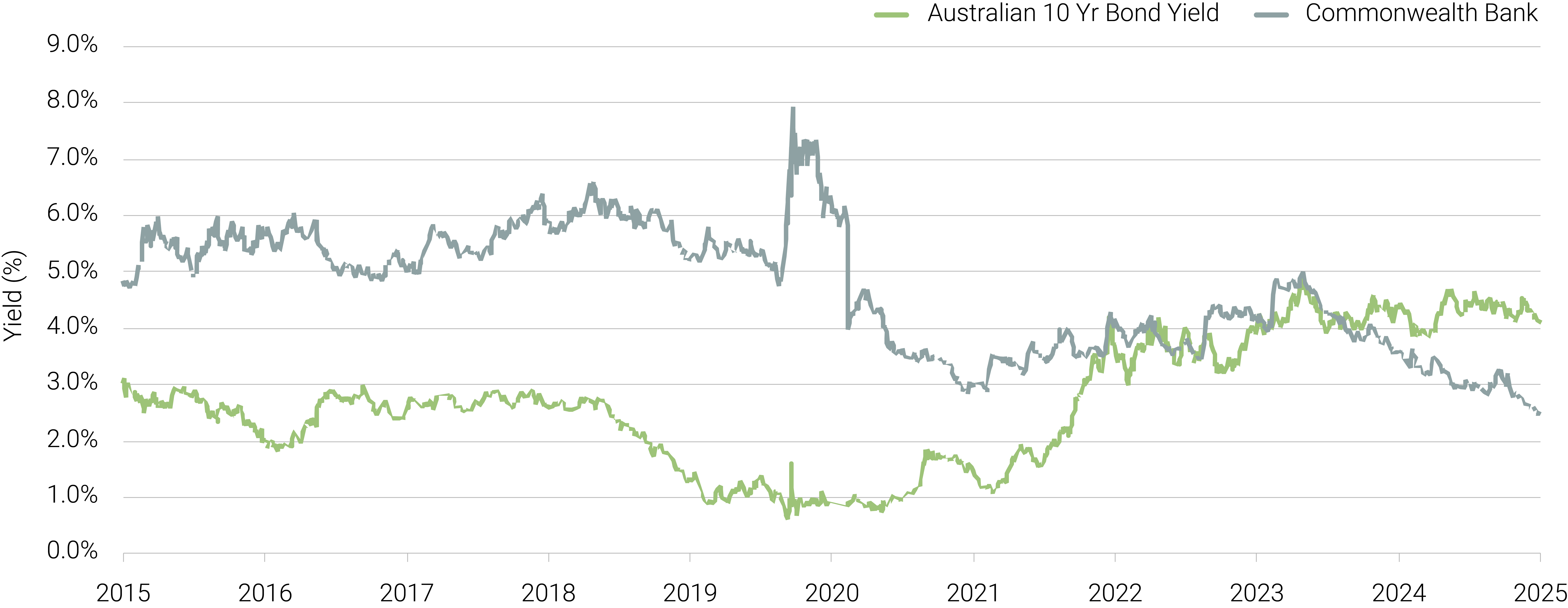

Reflecting on my FY24 Investment Manager’s Report, I dedicated significant discussion to the distinctive market dynamics that emerged, where valuations were often overshadowed by the influence of passive capital flows and index inclusion. A prime example was the share price of Commonwealth Bank of Australia Ltd (ASX: CBA), which soared to a record valuation despite maintaining a flat earnings per share (EPS) profile for several years.

Fast forward to the end of FY25, and this market dynamic, if anything, has only strengthened, and generally, equity investors of all types are being forced to ‘play the game’ and therefore focus on companies that form part of the index or are a good chance of index inclusion in the short term.

Turning to CBA, its share price, excluding dividends, has increased by +46% in FY25, following a 37% increase in FY24, marking the seventh consecutive year of share price growth. For further context, the chart below compares the grossed-up yield of CBA shares to Australian Government 10-year bond yields over a 10-year period. As the chart illustrates, despite CBA’s flat profit growth outlook, its shares are arguably being priced similarly to a government bond. This suggests investors perceive CBA’s risk profile as being closely correlated with the Australian government’s balance sheet.

Commonwealth Bank vs Australian 10 Year Bond - Yield

CBA has several qualitative attributes that continue to drive its rising valuation. In our view, these include:

From a NAOS standpoint, we will continue to focus on what we can control. Our investment philosophy centres on investing in emerging companies that deliver high returns on invested capital and are led by experienced, aligned management teams. These companies operate in industries poised for sustained revenue growth, where they hold clear competitive advantages, and their business models are transparent to investors. Notably, 100% of NSC’s portfolio is outside the ASX indices, ensuring our investments diverge significantly from the benchmark, the S&P/ASX Small Ordinaries Accumulation Index.

Below, I have expanded upon a number of core investments within the NSC investment portfolio, outlining why we believe these companies have the potential to generate significant long-term value for shareholders irrespective of their share price movements in FY25.

COG Financial Services (ASX: COG) – Board Overhaul and Strategic Reset

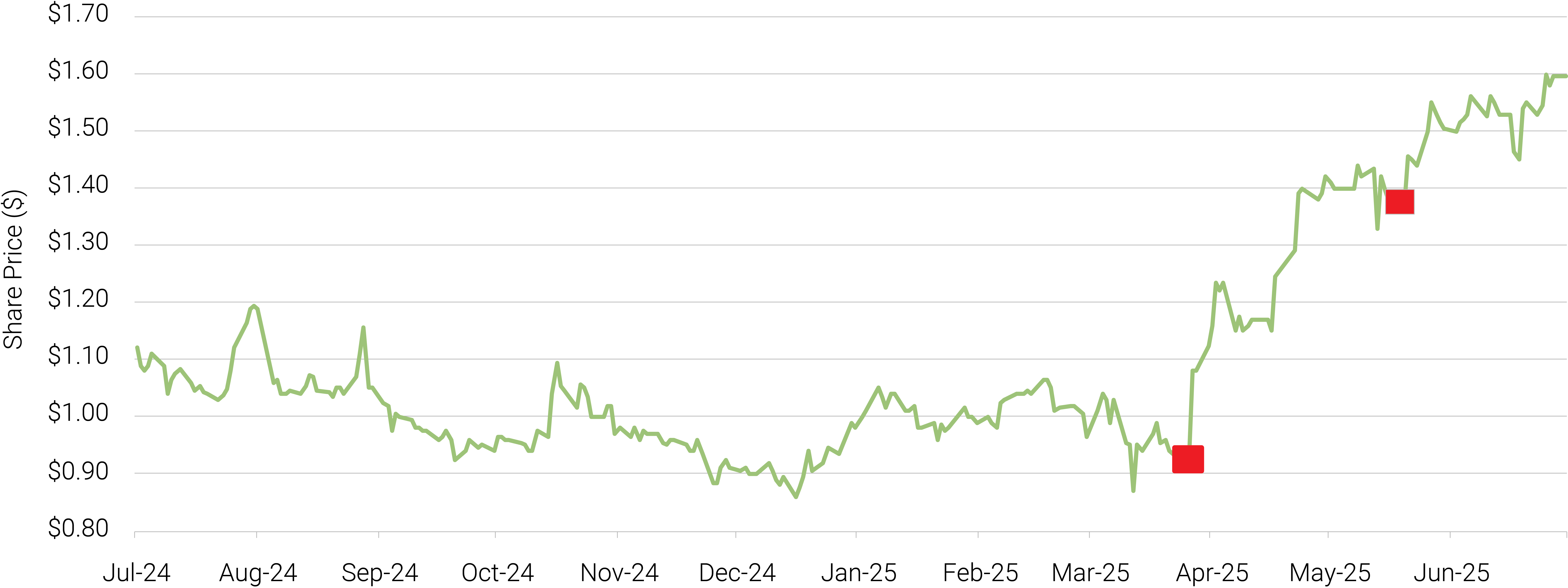

In last year’s letter, I outlined the critical changes we felt were necessary for COG to restore shareholder value and establish a sustainable path to growing earnings per share (EPS). Through early FY25, COG persisted with its prior strategy, resulting in a share price decline from $1.10 to a low of $0.86 in March 2025.

COG Financial - Share Price & Key Events

This trajectory shifted dramatically following a significant board overhaul: three directors, including the Chair, resigned, one transitioned to a non-executive role, and two new non-executive directors were appointed, with one assuming the Chair position. To support this transition, NAOS and other major shareholders sold a significant portion of their holdings, which enhanced liquidity in COG shares and enabled new directors and institutional investors to acquire meaningful stakes. We believe owning a smaller share of a revitalised, high-potential business is preferable to a larger stake in an underperforming company with limited prospects for improvement.

The most notable outcome of all the changes mentioned above was the appointment of Tony Robertson as Chair and John Dwyer as a Non-Executive Director. These appointments are significant for several reasons:

PSC Insurance - Share Price

With the new board in place, COG has swiftly advanced its simplification strategy. The sale of minority stakes in Earlypay Ltd (ASX: EPY) and Centrepoint Alliance Ltd (ASX: CAF) has generated ~$25 million in cash proceeds. The remaining step in this simplification effort, in our view, is addressing the Westlawn Group, COG’s asset management business. We believe this business contributes less than $2 million to group profitability but adds significant complexity to the balance sheet and cash flow statement due to Westlawn’s debenture program. If this business were to be sold, it would enable current and prospective shareholders to clearly see the capital-light nature and strong free cash flow generated by COG’s core operations.

Ultimately, for COG to achieve long-term success, it must deliver consistent organic earnings growth, even if that growth rate is ~5-10% p.a. While the full strategy is yet to be disclosed, we anticipate that Robertson and Dwyer’s insurance broking expertise will drive improvements in COG’s underdeveloped insurance broking division. Given the thousands of finance broking transactions that occur through a COG-owned or aligned broker, the potential for cross-selling insurance products is substantial.

At the very least, we believe COG now has a credible opportunity to unlock its full potential as Australia’s largest finance, broking & aggregation business. While its ultimate scale and valuation remain uncertain, comparable businesses with steady organic growth and strategic acquisitions have historically commanded premium earnings multiples. Accordingly, COG’s future valuation could be significant, provided it executes effectively under its revitalised leadership.

MaxiPARTS (ASX: MXI) – Half-Year Results, ATSG Dispute Settlement and Other Initiatives

MaxiPARTS (ASX: MXI) has presented challenges for investors seeking to assess its true value, given the numerous moving parts and one-off events that have occurred over the past two to three years. However, the release of a cleaner half-year result in FY25 has been a welcome development for shareholders. This provides a clearer view of MXI’s cash flow generation (see the chart below), ongoing margin improvements, and organic revenue growth, marking a step towards a more stable operating environment over the next 18 months. While a single half-year result does not establish a trend, we believe it lays the foundation for investors to make informed assumptions about revenue growth, margin enhancement, and cash flow consistency—metrics typically predictable in MXI’s distribution business.

Operating Cashflow

A significant factor in MXI’s complexity was its strained relationship with Australian Trailer Solutions Group (ATSG), which acquired MXI’s loss-making trailer operations a few years ago under a vendor finance agreement. This tension escalated into legal proceedings as MXI sought to recover owed payments. In mid-FY25, MXI announced a $2.2 million settlement in its favour, resolving the dispute. Though less than the full vendor finance amount, this outcome delivers certainty, frees the executive team from a significant distraction and allows both parties to part ways. With the agreement ending, MXI can discontinue supplying low-margin products to ATSG (a requirement for a period of time under the sale agreement), potentially boosting overall margins and optimising warehousing space previously occupied by bulky, lower-margin items. For a distribution business like MXI, we believe that incremental improvements in efficiencies and returns on capital can meaningfully enhance profitability.

Adding to this, at the end of FY25, MXI announced it had renegotiated its debt facility with the Commonwealth Bank of Australia, renewed their exclusive, nationwide Forch distribution agreement with the German parent company, acquired the outstanding minority interests (20%) of the Forch Australia business (so now MXI owns 100%) and finally has announced the opening of a new Kalgoorlie store which will commence trading in August 2025. Although these are incremental positive improvements, as detailed below, we believe that these improvements signal the start of significant gains for MXI shareholders in FY26 and FY27.

Outlook for FY26

At our October 2024 national roadshows, we emphasised the goal of delivering a +10-20% return for the NSC portfolio in FY25, supported by the low valuations of our core holdings and modest earnings growth projections.

FY25 was shaped by the BSA outcome, which masked what was otherwise a year of underlying progress. Excluding that specific event, the portfolio delivered +5.6% in the seven months to January and rebounded by +20% from March to June. This recovery was not coincidental; it demonstrates the strengthened qualitative and quantitative attributes of our core holdings.

In my experience, often the last thing to change for many businesses is the share price. Emerging companies usually need one or more catalysts to spark a valuation surge, and below, I highlight key FY26 catalysts for select holdings, each poised to drive substantial market re-ratings:

MaxiPARTS (ASX: MXI)

MXI’s Japanese Sales

Big River Industries (ASX: BRI)

COG Financial Services (ASX: COG)

MOVE Logistics (NZX/ASX: MOV)

While the catalysts outlined above may appear nuanced, we believe their realisation in FY26 could deliver substantial shareholder value, particularly if accompanied by valuation re-ratings and sustained earnings growth.

This reinforces our conviction that the intrinsic value of our investments significantly exceeds their current share prices, despite the modest performance in FY25. We remain optimistic that, building on FY25, the Investment Portfolio can achieve significantly strong cumulative returns by FY26, driven by the strength of our core holdings.

I look forward to updating you over the next 12 months on the progress of these investee companies concerning these catalysts, and we remain confident that many should materialise as anticipated. The NAOS team and I remain steadfastly committed to delivering sustainable, positive returns for all NSC shareholders through a concentrated portfolio of Australian and New Zealand emerging companies.

I would also like to acknowledge our long-standing NSC shareholders for their unwavering support, particularly during periods of performance volatility. As a sign of my confidence in NSC’s long-term value creation, I have continued to acquire shares and will do so as long as this potential remains.

Kind regards,

Sebastian Evans

Managing Director and Chief Investment Officer

NAOS Asset Management Limited

NAOS Asset Management is a specialist fund manager that provides concentrated exposure to quality Australian and New Zealand emerging companies.

NAOS takes a concentrated and long-term approach to investing and aims to work collaboratively with businesses rather than be a passive shareholder. NAOS seeks to invest in businesses with established moats and significant exposure to structural industry tailwinds, which are run by proven, aligned and transparent management teams who have a clear understanding of how to compound capital.

We aim to make significant investments in businesses and, on occasion, seek board representation or appoint highly regarded independent directors. Importantly, NAOS, its Directors and staff are significant shareholders in the NAOS LICs, ensuring strong alignment with all shareholders.

NAOS is B Corp Certified. As a B Corp in the financial services industry, we are counted among businesses that are leading a global movement for an inclusive, equitable and regenerative economy.

NAOS launched its first LIC in 2013 with 400 shareholders. Today, NAOS manages three LIC vehicles and one private investment fund for approximately 6,000 shareholders.

We believe in investing in businesses where the earnings today are not a fair reflection of what the same business will earn over the longer term. Ultimately, this earnings growth can be driven by many factors, including revenue growth, margin growth, cost cutting, acquisitions and even share buybacks. The result is earnings growth over a long-term investment horizon, even if the business was perceived to be a value-type business at the time of the initial investment.

Excessive diversification, or holding too many investments, may be detrimental to overall portfolio performance. We believe it is better to approach each investment decision with conviction. In our view, to balance risk and performance most favourably, the ideal number of quality companies in each portfolio would generally be zero to 20.

As investors who are willing to maintain perspective by taking a patient and disciplined approach, we believe we will be rewarded over the long term. If our investment thesis holds true, we persist. Many of our core investments have been held for three or more years, where management execution has been consistent and the value proposition is still apparent.

We believe in backing people who are proven and aligned with their shareholders. One of the most fundamental factors consistent across the majority of company success stories in our investment universe is a high-quality, proven management team with “skin in the game”. NAOS Directors and employees are significant holders of shares on issue across our strategies, so the interests of our shareholders are well aligned with our own.

This means we are not forced holders of stocks with large index weightings that we are not convinced are attractive investment propositions. We actively manage each investment to ensure the best outcome for our shareholders, and only invest in companies we believe will provide excellent, sustainable, long-term returns.

As a specialist fund manager since 2004, over the years NAOS has developed a strong “circle of competence” (or mental models) in specific industries. We openly acknowledge we avoid businesses that are either too complex to understand, or heavily influenced by one or two variables, such as interest rates or commodity prices. Instead, we concentrate on businesses that fall within our circle of competence, aiming to minimise the risk of permanent capital loss. Unlike others, we are comfortable setting aside investments that we consider “too hard”, while we compound our knowledge in specific industries where we believe we have a competitive edge.

We believe in taking advantage of inefficient markets. The perceived risk associated with low liquidity (or difficulty buying or selling large positions) combined with investor short-termism, presents an opportunity to act based purely on the long-term value proposition, where the majority may lose patience and move on. Illiquidity is often caused by aligned founders or management having significant holdings in a company. The NAOS LICs benefit from a closed-end structure, which means they do not suffer “redemption risk” and we can focus on finding quality, undervalued businesses regardless of their liquidity profile.

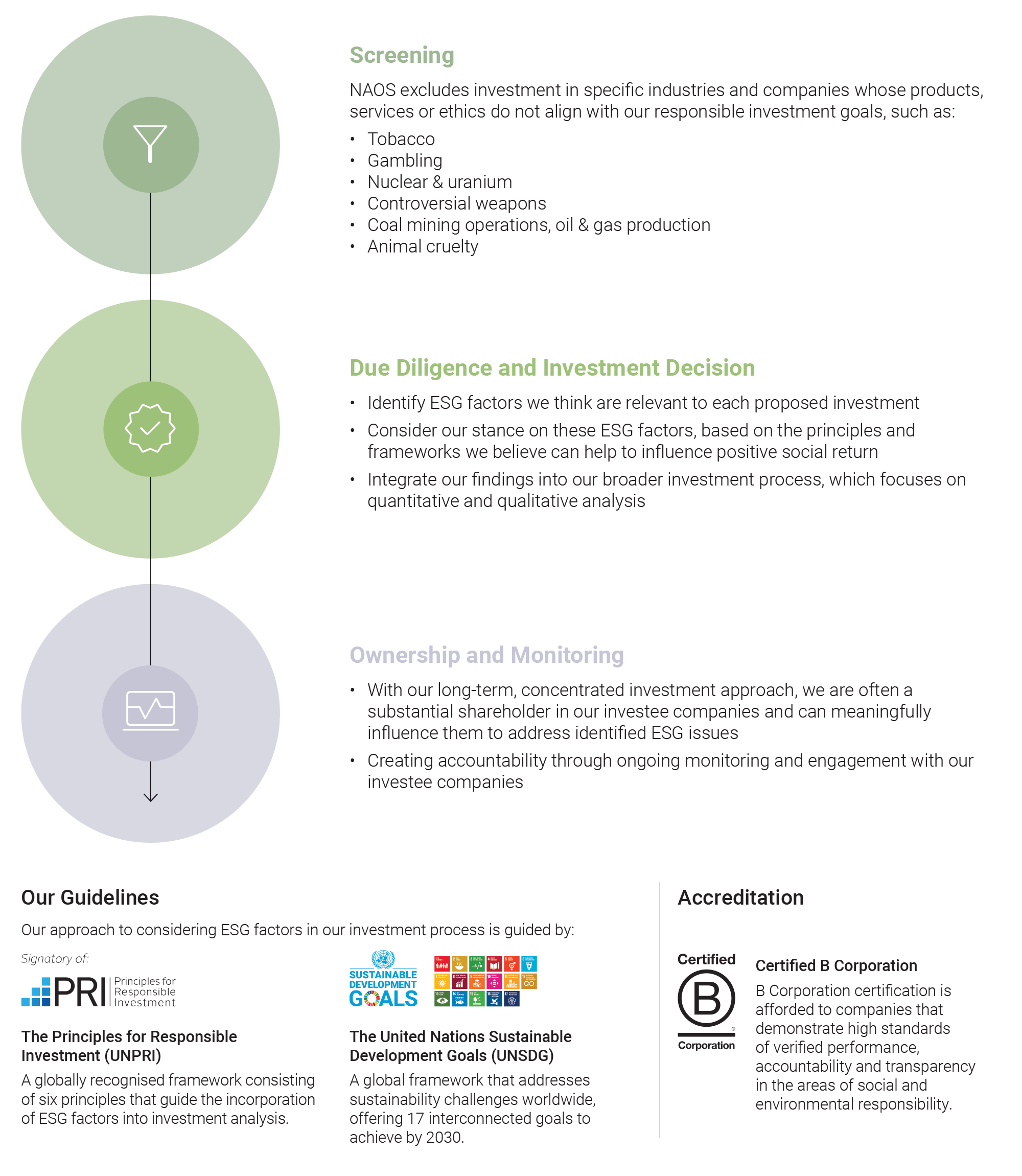

As an investment manager, NAOS recognises and accepts its duty to act responsibly and in the best interests of shareholders. We believe a high standard of business conduct and a responsible approach to environmental, social, and governance (ESG) factors is associated with a sustainable business model over the longer term. This benefits not only shareholders, but also the broader economy. NAOS is a signatory to the United Nations-supported Principles for Responsible Investment (UNPRI) and is guided by these principles in incorporating ESG into its investment practices. NAOS is also B Corp certified.

At NAOS, we seek to work collaboratively with businesses and their respective management teams. We are often the largest shareholder in the businesses we invest in, and from time to time we will seek board representation, either via an independent or a non-independent representative. This approach allows us to supportively engage with the boards and/or management teams of our portfolio holdings, and maximise the potential for our invested capital to compound at a satisfactory rate over the long term.

Examples of constructive engagement where the NAOS investment team looks to add value include:

Company Size & Security Type

Remove: ASX Top 50, <$20m market cap, ETFs

Revenue

Remove: No substantial revenue

Industry

Remove: Industries in structural long-term decline and not conducive to long-term growth

ESG Negative Screen: Tobacco, Gambling, Nuclear and Uranium, Controversial Weapons, Coal Mining Operations, Oil and Gas Production and Animal Cruelty

Balance Sheet

Remove: Unsustainable debt levels

Management & Culture

Valuation, Growth & Margin of Safety

Considering ESG Factors

ASX: NCC NAOS Emerging Opportunities Company Limited

NCC generally invests in 0-20 Australian and New Zealand emerging companies.

ASX: NAC NAOS Ex-50 Opportunities Company Limited

NAC generally invests in 0-20 Australian and New Zealand emerging companies.

ASX: NSC NAOS Small Cap Opportunities Company Limited

NSC generally invests in 0-20 Australian and New Zealand emerging companies.

NAOS also follows this Investment Criteria when investing in private emerging companies.

The NAOS investment team undertakes fundamental analysis on potential and current investments. Some examples of key focus areas include:

At NAOS, as an investment manager, we recognise and accept our duty to act responsibly and in the best interests of all stakeholders. We believe that a high standard of business conduct and a responsible approach to environmental, social and governance (ESG) factors are associated with a sustainable business model over the longer term, which also benefits the broader economy.

We recognise the material impacts that ESG factors can have on investment returns and risk, and also the wider implications for achieving a positive social return.

At NAOS Asset Management, we believe in providing shareholders with meaningful insights into the companies in which we invest. We recently spoke with John Lorente, Managing Director and CEO of Big River, to gain a deeper understanding of the company’s strategic priorities, competitive positioning, and long-term alignment with shareholders.

How is Big River positioned to benefit from long-term construction trends?

Big River is well-placed to capitalise on Australia’s structural tailwinds—such as population growth, housing demand, and infrastructure investment—through its national footprint, diverse product mix, and vertically integrated manufacturing. We focus on trade customers and high-growth segments, with targeted expansion into categories that offer margin resilience. Strong relationships with leading brands, deep category expertise, disciplined capital allocation, and a focus on innovation enable us to unlock opportunities and create value throughout the construction cycle.

What sets Big River apart from competitors?

We combine national scale with local service and deep trade expertise. Our model focuses on value-added solutions, consistent pricing with local flexibility, and strong supplier partnerships. Digital tools and automation help protect margins and improve customer experience.

What impact has your national expansion had on customer service and growth?

Our national footprint combines local service with coordinated support, allowing builders to access consistent products, pricing, and service across regions. This simplifies operations and strengthens our role as a trusted partner. The acquisition of Timberwood Panels, for example, expanded access to premium certified panels nationwide. Customers benefit from improved lead times, reliable supply, and a seamless experience, driving repeat business and supporting revenue growth.

How are you responding to sustainability and prefabrication trends?

We’re meeting the growing demand for sustainable construction by expanding our range of certified timber and environmentally responsible panel products. Our manufacturing sites produce PEFC- and FSC-certified plywood, and our national distribution network offers a range of low-emission and recycled materials. At the same time, our investment in Frame & Truss capabilities supports the shift toward modular prefabrication, further strengthening our customer value proposition.

How does your strategy align with shareholder expectations?

We focus on sustainable growth, margin expansion, and operational efficiency, driven by optimised sales, disciplined category strategies, and cost-to-serve improvements. Investments in people, automation, and digital platforms are streamlining operations and enhancing execution. Our targeted trade focus enables us to offer higher-margin, value-added products backed by technical expertise. Growth is delivered through a mix of organic initiatives and selective acquisitions, ensuring long-term shareholder value while managing risk.

Sebastian is a Director of NAOS Emerging Opportunities Company Limited (ASX: NCC), NAOS Small Cap Opportunities Company Limited (ASX: NSC), NAOS Ex-50 Opportunities Company Limited (ASX: NAC), and has held the positions of Chief Investment Officer (CIO) and Managing Director of NAOS Asset Management Limited, the Investment Manager, since 2010. Sebastian is the CIO across all investment strategies.

Sebastian holds a Master of Applied Finance (MAppFin) majoring in investment management, as well as a Bachelor of Commerce majoring in finance and international business, a Graduate Diploma in Management from the Australian Graduate School of Management (AGSM) and a Diploma in Financial Services.

Robert joined NAOS in September 2009 as an investment analyst. Robert has been a portfolio manager since November 2014 and is currently Portfolio Manager across all NAOS LICs: NAOS Emerging Opportunities Company Limited (ASX: NCC), NAOS Small Cap Opportunities Company Limited (ASX: NSC), and NAOS Ex-50 Opportunities Company Limited (ASX: NAC), and the NAOS Private Opportunities Fund. Robert is also a non-executive director of Ordermentum Pty Ltd.

Robert holds a Bachelor of Business from the University of Technology, Sydney, and a Master of Applied Finance (MAppFin) from the Financial Services Institute of Australasia/Kaplan.

Jared joined NAOS in April 2021 as Senior Investment Analyst. Jared has over 17 years’ financial services experience. Most recently, Jared was an investment analyst at Contact Asset Management and prior to that he spent nine years at Colonial First State.

Jared holds a Bachelor of Commerce majoring in accounting and finance from the University of Notre Dame, Sydney, and is a CFA Charterholder.

Tom currently studying a Bachelor of Commerce (Finance) at The University of Sydney, where he has developed a strong interest in investing and portfolio management.

Mohit Kabra is the Chief Financial Officer (CFO) and Chief Operating Officer (COO) at NAOS Asset Management. Since joining NAOS in 2025, he has been responsible for NAOS's financial strategy and overseeing its operations. With a strong focus on governance, financial planning, and regulatory compliance, Mohit plays a key role in driving NAOS’s strategic direction and long-term success.

With over 17 years at Deloitte Touche Tohmatsu across three continents, Mohit has developed deep expertise in investment management. His experience spans audit, accounting, advisory services, mergers and acquisitions, financial due diligence, business valuations, and capital market transactions.

Mohit is a Certified Public Accountant (CPA) with the Colorado Board of Accountancy and a member of the American Institute of Certified Public Accountants (AICPA). He is also an associate member of the Institute of Chartered Accountants of India and holds a Bachelor of Commerce (Hons.) from the University of Delhi, India.

Rajiv is Head of Legal and Compliance at NAOS and holds a Bachelor of Laws (First Class Honours), a Bachelor of Business (accounting major) and a Graduate Diploma in Legal Practice from the University of Technology, Sydney.

Rajiv has over 15 years’ experience, having most recently held senior legal roles at Custom Fleet, part of Element Fleet Management (TSX: EFN), and also at Magellan Financial Group (ASX: MFG). He has also previously worked at law firms Johnson Winter & Slattery, and Clayton Utz.

Rajiv is a member of the Law Society of New South Wales and is admitted to the Supreme Court of New South Wales and the High Court of Australia.

Angela joined NAOS in May 2020 in the capacity of Marketing and Communications Manager.

Prior to joining NAOS, Angela held marketing roles for companies in both Australia and the UK, including SAI Global, American Express, Citibank, and Arete Marketing.

Angela holds a Bachelor of Communications majoring in advertising and marketing from the University of Canberra.

To be caretakers of the next generation, we must actively support positive change. Supporting our commitment to ESG issues, NAOS Asset Management (the management company) donates 1% of recurring revenue to the community and the environment.

NAOS is proud to be supporting:

The Board of NAOS Small Cap Opportunities Company Limited is committed to achieving and demonstrating the highest standards of corporate governance. As such, the Company has adopted what it believes to be appropriate corporate governance policies and practices having regard to its size and the nature of its activities.

The Board has adopted the ASX Corporate Governance Principles and Recommendations, which are complemented by the Company’s core principles of honesty and integrity. The corporate governance policies and practices adopted by the Board are outlined in the Corporate Governance section of the Company’s website naos.com.au/corporate-governance.